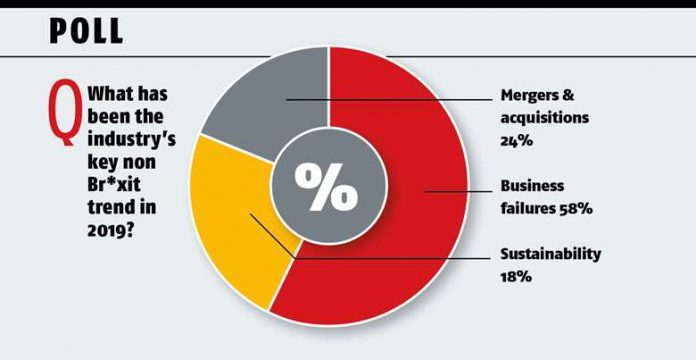

It has been a lively – some would say tumultuous – year for print. Brexit aside, the sector saw a number of major trends in 2019, but perhaps most notably M&A activity, business failures, and sustainability.

Among this year’s many M&A deals, tireless Paragon acquired parts of Howard Hunt and RR Donnelley’s European Global Document Solutions business and Geoff Neal joined forces with Hardings Print Solutions to buy Evoteam.

DS Smith, meanwhile, completed its acquisition of Europac, had its plastics division acquired by private equity firm Olympus Partners, and saw two of its packaging businesses snapped up by International Paper.

M&A popularity is driven by multiple factors. Nicholas Mockett, head of packaging M&A at Moorgate Capital, points to natural market maturity.

“Printers are coming together to realign capacity and exploit economies of scale,” he says. “A bigger business should be able to spread overheads and may also have synergies on the supply side – such as procurement of paper, inks and capital equipment.”

What’s more, he adds, acquirers may be attracted by growth in specialist print markets – particularly the printed packaging segment, given the rise of online shopping.

In short, M&A is a means to consolidate and extend companies’ markets – to optimise portfolios, broaden customer bases, and form strategic alliances – which can be attractive in an age of print instability. And as Mockett notes, “often when a major deal takes place in a sector, it sets off a wave of deals as competitors race to bulk up to compete”.

The trend looks set to continue, he says. “I cannot foresee traditional print markets ceasing to exist entirely, but segments will continue to see decline. Specialist printing markets and services will continue to experience growth in 2020 and beyond.”

The future looks bright even for smaller outfits, so long as they are savvy and willing to seek out new niches, he suggests.

“As consolidation continues, printers may find that they are unable to compete with larger players. However, with scale comes complexity and a more fleet-of-foot enterprise may be able to service customers more adeptly.”

M&A is of course also a reaction to business failures; another of this year’s key trends.

Administrations, liquidations, and pre-packs have unfortunately dominated the headlines. Howard Hunt collapsed in May, owing nearly £30m, with Paragon acquiring parts of the group in a pre-pack deal. Odessa Print Group (reprised as Odessa UK), Latimer Trend and parts of the Bradley Group also hit the rocks this year.

ICSM Credit owner Ian Carrotte suggests the trend is due to wider shifts in shopping and marketing, which have become increasingly digital.

“The internet, technology and the overall economy have all played their part in cutting the need for print,” he says. “The decline of the high street as the go-to place to buy almost anything has had a knock-on effect.

“For every large business that goes to the wall, several printers, paper manufacturers, and signage and graphic designers are all hit.”

RSM UK restructuring advisory director David Shaw, meanwhile, cites market saturation: “There continues to be a squeeze on profitability with high levels of competition driving prices down, costs increasing and no real overall growth within the sector”.

Aside from digitisation and retail market shifts, he lists common factors contributing to market challenges as including paper, pay, and energy costs; the tightening of GDPR which impacts traditional use of direct marketing; and reduced credit insurance limits.

So what can those struggling do? Shaw suggests looking to professionals for advice: “Acting early can reduce the impact on suppliers, employees, and lenders alike”.

Carrotte adds: “For a firm to survive a downturn, it needs to pull in any excesses”. And to avoid issues in the first place, he says, “cash flow is king, so the most important rule for all firms is to have a disciplined credit control”.

Both Shaw and Carrotte agree that insolvency will likely continue trending in 2020. “The political uncertainty doesn’t help,” says Carrotte.

Unsurprisingly, in the year of Greta Thunberg, Extinction Rebellion and the controversial Environment Bill, sustainability was another top trend in 2019.

Never before has such a variety of recycled paper, sustainable inks, plastic film and polywrap alternatives, and energy-efficient equipment been available, and printers are embracing it with growing speed.

Print Consultants managing director Gerrard Moss says: “We’re seeing printers thinking about sustainability right from the beginning of the process – from where they source their paper to what inks they use.”

Many print companies have made their eco-friendly credentials a drawcard to match growing environmental concern among clients – and the trend seems set to continue, with climate issues increasingly in the public eye. As Clare Taylor Consulting senior consultant Clare Taylor says, “sustainability is finally coming off the back pages and into the mainstream”.

The year saw the launch of AMS’s Eco-Mailbag and also saw HP extend its Sustainable Impact programme, investing £155m in water-based ink technology; St Austell Printing won Printweek’s Environmental Company of the Year; Navigator invest £138m in reaching carbon neutrality by 2035; Pro Carton introduce an environmental education initiative to Europe; and the fourth annual Big Plastics Debate at the Packaging Innovations expos.

The trend is set to continue in 2020, experts agree. “I think people in the industry are becoming aware that [thinking about the environment is] not just something that’s nice to do, it’s something that’s essential to our survival,” says Taylor.

In sum, it’s been a colourful year. What’s certain is that the industry still offers many opportunities, whatever cuts it may have suffered, and with new areas for growth and focus, continuous change, and fresh sustainability goals, print is set for a vibrant 2020.